Revolut Ltd., Europe’s most valuable fintech firm, is set to expand its services by offering trading of UK and EU-listed stocks from next year. This move comes as competition intensifies among retail brokers serving British investors. Headquartered in London, Revolut recently secured a UK banking license and has now received approval from the Financial Conduct Authority (FCA) to operate as an investment firm, the company announced on Monday. While the FCA declined to comment, this approval marks a significant milestone for Revolut’s expansion.

Revolut has been developing the necessary technology to support UK and EU-listed products even before receiving regulatory approval. Yana Shkrebenkova, the company’s UK head of wealth and trading, highlighted that the new trading license will enable Revolut to onboard a wider range of brokers to manage client assets, thereby expanding its customer base in the UK. Revolut’s entry into the UK stock trading market places it in direct competition with established players such as Trading 212 Group Ltd., Freetrade Ltd., Hargreaves Lansdown Plc, and AJ Bell Plc. The UK government, eager to promote investment in local equities, recently prompted the FCA to revamp its listing rules in July to enhance market attractiveness.

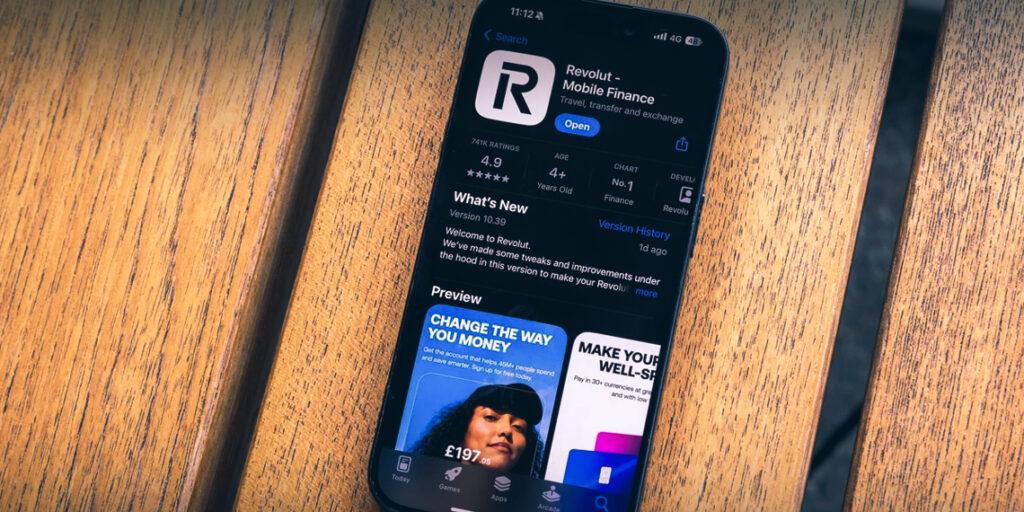

Currently, Revolut offers trading of US-listed stocks through its app via a partnership with a regulated third-party provider. The firm serves around 650,000 trading customers in the UK out of its more than 10 million registered app users. In September, Revolut introduced a standalone investment app across multiple European countries to compete with global players like Robinhood Markets Inc. and eToro Group Ltd., aiming to attract customers who prefer investment services independent of banking.

Should its European pilot program succeed, Revolut plans to launch the standalone app in the UK. Additionally, the fintech giant is exploring support for tax-advantaged accounts such as stocks and shares ISAs, along with bonds. Margin investing services may also be introduced in the future, following a model similar to that of competitor Robinhood.

Founded in 2015, Revolut’s valuation recently reached $45 billion after a secondary share sale. The company has further ambitions, including a potential initial public offering, as noted by its UK Chief, Francesca Carlesi, in March.