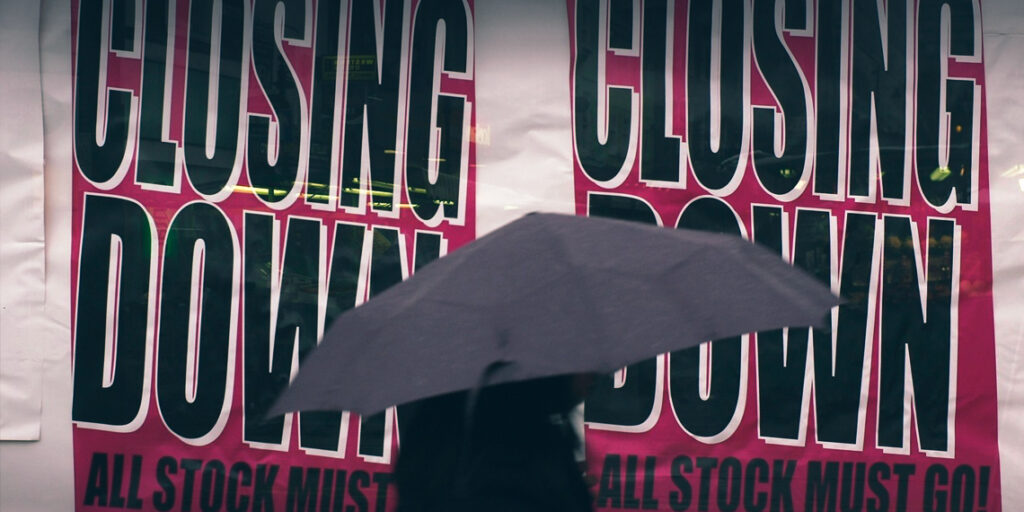

Almost 170,000 retail jobs have been lost in 2024, driven by the collapse of several high street chains, according to new data from the Centre for Retail Research.

This marks the highest job losses in the sector since the aftermath of the COVID-19 pandemic in 2020, when more than 200,000 retail positions were cut due to lockdowns.

The latest figures reveal that a total of 169,395 retail jobs have been lost this year, representing an increase of 41.9% compared to 2023, when 49,990 fewer jobs were shed.

A significant proportion of these job losses are attributed to the closures of major retailers, such as Homebase and Ted Baker, which faced financial difficulties and went into administration.

Other well-known brands, including Lloyds Pharmacy, The Body Shop, and Carpetright, also contributed to the rising job losses, with 38 major retailers collapsing in 2024.

Around 33% of the job losses, about 55,914 roles, were directly linked to the collapse of businesses. The remainder of the job cuts resulted from “rationalisation” measures, such as cost-cutting programmes by larger retailers and independent shops closing permanently.

Professor Joshua Bamfield, Director of the Centre for Retail Research, explained that the relatively low figures in 2023 were an anomaly.

He noted that changes in consumer shopping habits, coupled with rising inflation, higher energy costs, and increasing rents and business rates, have forced many retailers to make further cuts in 2024.

Independent retailers, which typically operate small businesses with just one to five stores, were hit hard, shedding 58,616 jobs in total during the year.

Looking ahead, 2025 is expected to bring further challenges for the high street, with experts predicting additional strain on businesses.

The upcoming rise in national insurance contributions, alongside the reduction in the business rates discount, is set to add financial pressure.

From 1 April 2025, the current 75% discount on business rates will be slashed to 40%, with the maximum discount remaining capped at £110,000.

Alex Probyn, president of property tax at real estate adviser Altus Group, warned that the business rates discount cut will disproportionately impact independent retailers, potentially increasing their bills by an average of 140%, or an additional £5,024 for the average shop.

As the retail sector continues to struggle with economic challenges, the outlook for 2025 suggests that job losses and store closures may rise further, putting more pressure on the already beleaguered high street.