The UK economy faces mounting pressure as proposed tariffs from former US president Donald Trump threaten global trade, the country’s fiscal watchdog has warned.

With slow growth and high debt levels already weighing on public finances, experts fear the UK could be vulnerable to further economic disruption.

Chancellor Rachel Reeves has introduced spending cuts, including reductions to the welfare budget, to meet strict fiscal targets aimed at restoring investor confidence following the market turmoil of 2022 under former prime minister Liz Truss.

However, the Office for Budget Responsibility (OBR) has cautioned that a global trade war could weaken economic output, while rising interest rates and government borrowing costs could further strain the country’s finances.

Trump’s proposed reciprocal tariffs, set to take effect on April 2, target countries his administration believes are restricting US exports.

The OBR has warned that higher US import tariffs could slow UK economic activity beyond their direct impact on exports, estimating that a full-scale trade dispute could shrink the UK economy by up to 1%.

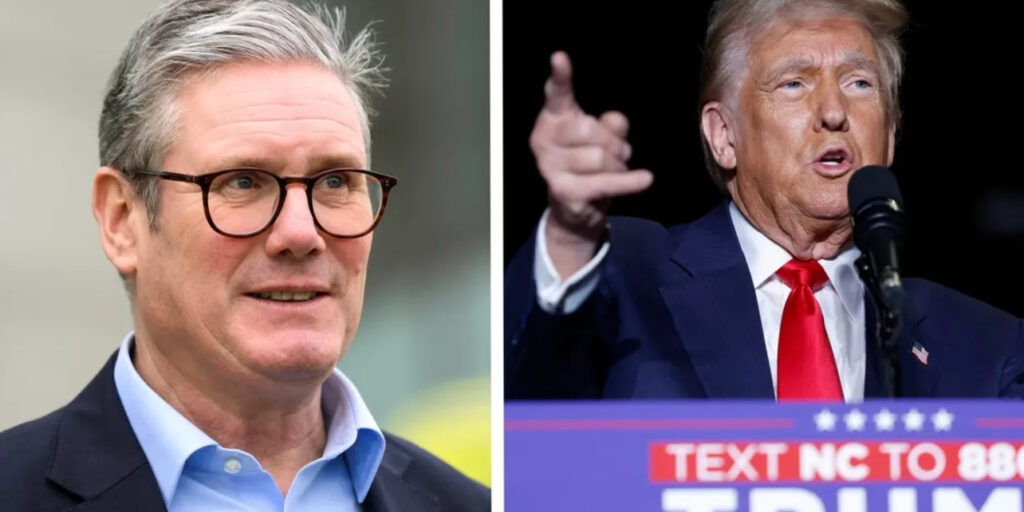

Despite efforts by Prime Minister Keir Starmer’s government to stimulate economic renewal, progress has been hindered by rising debt costs and sluggish growth. Reeves has already faced criticism for tax hikes on businesses in her first budget last October.

The recent announcement of welfare cuts, expected to impact 3.2 million families, has further fuelled concerns over the government’s economic strategy.

The OBR highlighted that if Bank of England interest rates and government bond yields rise by just 0.6 percentage points over the next five years, Reeves’ limited fiscal buffers could be wiped out, potentially forcing policy changes.

Even if Trump’s tariffs initially target China, Canada, and Mexico, retaliatory measures and market uncertainty could still have significant consequences for the UK economy.

The UK is currently negotiating a tech-focused trade deal with the US, which could help mitigate the impact of tariffs. Reeves has pointed to the strong relationship Starmer has developed with Trump, referencing improved trade relations during his previous term in office.

She reaffirmed the government’s commitment to free and open trade, stating that discussions would continue in the coming weeks.

The Liberal Democrats have criticised the government’s handling of the situation, warning that a lack of preparedness could derail economic plans. The opposition party accused ministers of failing to put forward a clear strategy to protect the economy from potential trade disruptions.

The growing fiscal challenges have also reignited calls for stronger measures to reduce the national debt, which now stands at around 95% of annual economic output. Some economists argue that tax increases will be necessary to stabilise public finances, particularly after multiple economic shocks, including the 2008 financial crisis, Brexit, COVID-19, and rising energy costs following Russia’s invasion of Ukraine.

The OBR projects that government borrowing will increase by an additional £47.6 billion by the end of the decade compared to forecasts made just five months ago.

Paul Johnson, director of the Institute for Fiscal Studies (IFS), warned that speculation over potential tax rises could persist in the coming months, with Reeves expected to deliver her next full budget statement in October or November. He noted that rising debt interest costs were already putting significant pressure on public spending, making further borrowing a risky long-term strategy.

With uncertainty surrounding global trade and ongoing fiscal pressures at home, the UK government faces a difficult balancing act in managing economic stability while preparing for potential financial shocks.