The UK is reportedly in the final stages of negotiating a landmark free trade agreement (FTA) with the Gulf Cooperation Council (GCC), a group of six oil-rich Middle Eastern nations, including Saudi Arabia, the United Arab Emirates (UAE), Qatar, Kuwait, Oman, and Bahrain. According to officials familiar with the discussions, this deal is a major focus for Prime Minister Keir Starmer’s government, which aims to stimulate economic growth and attract increased foreign investment. Sources, who spoke on condition of anonymity, suggest that the agreement could be finalized as early as this year.

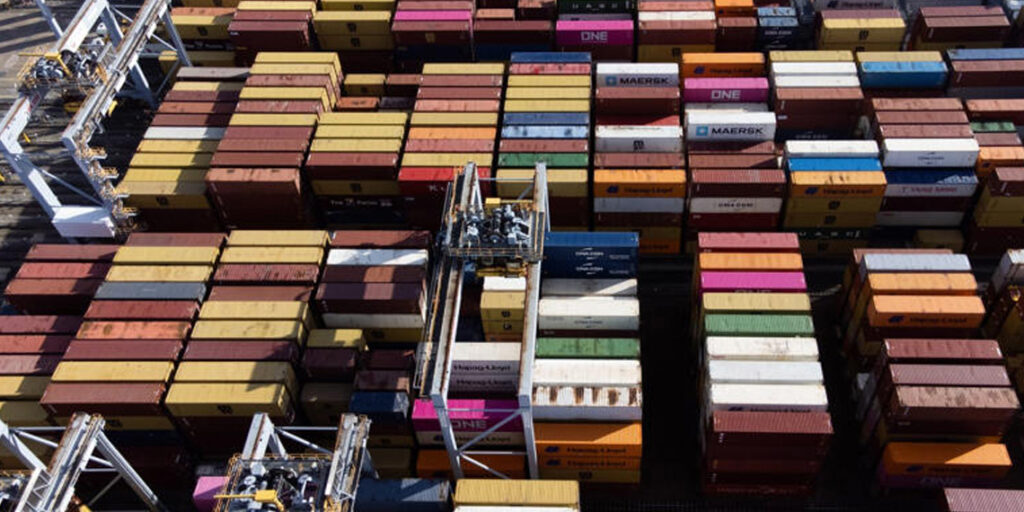

Trade between the UK and the GCC bloc currently amounts to $73 billion (£57 billion) annually, as per UK government data. The proposed FTA is expected to increase trade volume by approximately 16% and boost the UK economy by an estimated $2.1 billion over the long term. In a statement to Bloomberg, the Department for Business and Trade emphasized that such trade deals are integral to economic expansion. “We’re seeking a modern trade deal with the Gulf as a priority,” the department noted, stressing that their focus is on ensuring real value for businesses rather than adhering to a rigid timeline.

Securing this trade deal could provide a political win for the Labour government, which has not yet signed any FTAs since coming to power in July. Prime Minister Starmer has been vocal about his intentions to reset international relations and draw foreign investment to revitalize the UK’s economic landscape. FTAs typically lower trade barriers and ease tariffs, thereby enhancing business opportunities between countries.

Negotiating trade agreements has proven challenging for the UK since its departure from the European Union in 2020. While agreements have been secured with countries such as Australia and New Zealand, discussions with major economies like the United States and India have stalled. Ongoing negotiations also include countries like Switzerland and South Korea.

The GCC, with a combined gross domestic product (GDP) of approximately $2.2 trillion—comparable to that of Brazil—ranked as the UK’s seventh-largest export market last year. The bloc has existing FTAs with countries like New Zealand and Singapore and is currently in talks with the EU, India, and China, although those negotiations have been protracted.

Saudi Arabia, the UAE, and Qatar, while still heavily reliant on oil and gas, are making substantial efforts to diversify their economies. They are channeling hundreds of billions of dollars into sectors such as artificial intelligence, chip manufacturing, and tourism, with the goal of reducing their dependency on fossil fuels. These nations recognize the pivotal role of foreign investment in their economic transformation strategies. Sovereign wealth funds such as Saudi Arabia’s Public Investment Fund, Abu Dhabi’s Mubadala Investment Co., and the Qatar Investment Authority have been significant sources of investment in the UK over the past decade.

The UK and the GCC have conducted seven rounds of trade talks since 2022. Business and Trade Secretary Jonathan Reynolds was recently in Dubai, the commercial hub of the UAE, to advance negotiations. “We see a real opportunity here, a real partnership that is very strong,” Reynolds remarked to Bloomberg on November 1, emphasizing that a trade deal has the potential to bring substantial improvements.

Throughout the negotiations, the UK government has remained firm on its commitment not to compromise on environmental, public health, animal welfare, and food standards. Furthermore, the National Health Service (NHS) and its services are excluded from the talks.

Following the FTA, some GCC countries may seek to negotiate individual trade agreements with the UK. The UAE has already signed multiple bilateral agreements, known as Comprehensive Economic Partnership Agreements (CEPAs), which often address trade areas not covered under the GCC’s FTAs.